Note: The document was updated on Feb 15, 2024

Abstract:

ApeX is a non-custodial trading platform that delivers permissionless cross-margined perpetual contracts to its community under a new social trading framework. It is primed to deliver limitless access to the perpetual swap market with its order book model, as it remains committed to the promises of not just speed and efficiency, but also security with transparency on trades executed.

As ApeX continues to stay committed to building intuitive and transparent financial instruments for crypto derivatives traders of any background, it also recognizes the importance of creating an ecosystem that will allow more of such traders to enter the world of DeFi with ease and smoothly participate in a decentralized trading network.

As such, we have introduced the order book model on StarkWare’s Layer 2 scalability engine StarkEx, which provides higher performing trades and an enhanced experience users are familiar with. We aim to establish a social trading platform that benefits more experienced traders with more avenues of passive income, and less experienced traders who can observe and replicate the behavior, signals and strategies of other traders.

ApeX offers all traders accelerated trading performance and deep liquidity, while preserving privacy and security in the decentralized space — based on the core belief that trades made together in the Web 3.0 world are better.

1. Why Web 3.0 Social Trading

Trading opportunities abound in both the traditional finance and newer cryptocurrency markets as traders continuously seek new innovations to further build their wealth. Both trading markets, however, have one thing in common — a centralized trading model, where a single entity has control over a trader’s account and assets.

In the case of cryptocurrency, a centralized exchange (CEX) would own a trader’s private keys and digital assets, leaving them vulnerable to unforeseen situations such as bank runs, or the removal of withdrawal and trading services for an asset or trading pair. The lack of full ownership and open access threatens the sustainability of wealth preservation and growth for traders — the centralized trading framework is no longer sufficient in helping to meet their needs.

Traders expect faster, cheaper, and more efficient trades, no matter where they are located. Additionally, an increasing number of traders are constantly looking out for easy entry into trading innovations in new cryptocurrency trading ecosystems built with more sophistication.

ApeX Pro intends to solve the pain points of (1) limited global access, (2) unsatisfactory trade performance, and (3) insufficient security and privacy protection, with a simple but dynamic solution — social trading powered on a decentralized and permissionless network.

Look no further than traditional financial markets, where the likes of eToro, Zulutrade and more have jumped on social trading; but social trading restricted to the Web 2.0 sphere is hardly the most optimized solution to safe and efficient trading.

Let’s examine the core value propositions of social trading and why Web 3.0 is ApeX Pro’s solution for traders.

1.1 Challenges of Traditional Social Trading

Social trading — trading by leveraging social networks and interactions between traders in a community — is slowly but surely rising in popularity as a viable financial strategy. It is, currently, the most cost-efficient way to expand and revitalize communities of traders without the supervision of intermediaries.

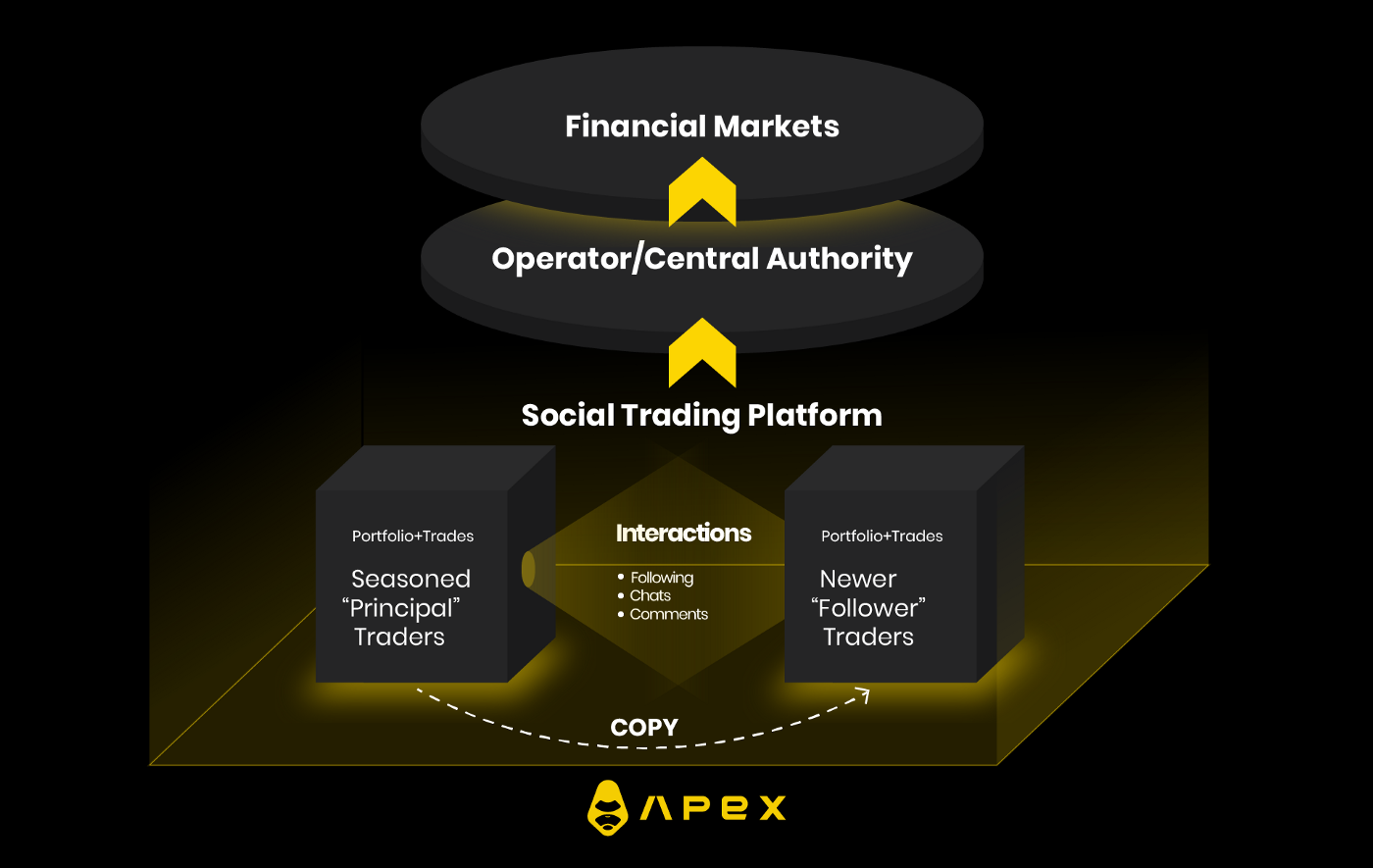

The chart above reveals the conspectus of entities involved in a typical, centralized social trading platform in its most prevalent form, copy trading.

A trader new to derivatives trades registers on the social trading platform and builds up their portfolio and trades by tagging their account to a more seasoned “Principal” trader’s account, matched by several factors including performance profile goals or risk preferences

A Principal Trader interacts with their followers on the platform with comments, messages and discussions, leading to an overall chain-effect of better, more robust trades within groups

The social trading platform, and both the accounts and assets of traders, are then subject to a centralized operator’s control, before traders can even access financial markets

It is evident that traditional social trading is susceptible to the flaws and vulnerabilities of CEXs, including:

Unnecessary Added Costs: Multiple intermediaries complicate and add layers to this end-to-end funnel

Limited Access: Trader identity verification is typically required with KYC and the requirements for becoming a Principal Trader may be arbitrary

Compromised Security & Privacy: CEX operators are privy to a trader’s trading history and other confidential information

1.2 Decentralized Social Trading Goals

ApeX Pro is delivering the best of social trading to traders without the presence of any intermediaries in the Web 3.0 realm. Incentivized for optimal cryptocurrency derivatives trading and performance, the infrastructure is designed to:

Accelerate Web 3.0 social trading development and ensure deep liquidity on a network scaled for growing trades

Allow traders to openly engage with other traders on ApeX Pro to improve trading performance and earn trading rewards

Foster community ownership over trading history and other personal data records, thereby reducing the risk of compromised security

Incentivize user participation on the platform by the distribution of a trading reward token via Trade-to-Earn

Fortify the social trading model with the use of SoulBound Tokens (SBTs), a non-transferable token representing a trader’s trading profile, patterns and history

Further solidify ApeX Protocol’s governance token APEX as a building foundation for other applications in the ecosystem

2. StarkEx Scalability Engine Integration Summary

Synchronizing StarkWare’s Layer 2 scalability engine StarkEx with ApeX Pro allows for accelerated and cheaper perpetual contract trades to be made, while still offering time-tested liquidity, market depth and transparency to traders.

ApeX Pro is leveraging StarkEx’s cryptographic proofs and Validium to securely validate transaction batches — non-custodial trading at its most efficient, with enhanced user performance and experience.

Maximum Security & Preserving Privacy

On-chain data availability and integrity can be ensured with StarkWare’s STARK proofs, a form of zero-knowledge proof (ZK-proof) technology that will help safeguard a fully non-custodial protocol. Built on the Ethereum network, this Layer 2 architecture publishes ZK-proofs directly to Ethereum smart contracts for verification. Transactions are also uniquely packaged for publishing on-chain for traders concerned about data privacy as only balance charges will be made visible.

This integration will increase ApeX Pro’s trade settlement capacity, while fortifying the secure validations of every transaction on the trading platform without compromising the privacy of a trader with respect to their personal transaction data and activities.

Boosted Multi-Chain Support

Open to tokens from the Ethereum network and also EVM-compatible chains, cross-chain deposits and withdrawals are supported on ApeX Pro. Traders get access to a wider variety of preferred assets and trading pair options to diversify their portfolio with.

Lower Fees, Leverage & Instant Settlement

With enhanced scalability on Validium, ApeX Pro alleviates common challenges such as exorbitant gas fees and prolonged settlement times. On top of that, amplified earnings are now possible as trades can be executed at up to 30x leverage, at the lowest costs with smaller starting capital — optimized trade sizes and speed for the rising trader.

3. ApeSoul — ApeX Pro’s Soulbound Token (SBT)

An alternative solution is required to determine the status of traders in the social trading process out of a centralized trading model and correspondingly, the parameters of trading activity.

In copy trading, the trading platform typically highlights seasoned “Principal” traders in the community for less experienced traders to observe and execute trades based on the trading activity of these experts.

Without implementing any traditional identity verification methods, ApeX Pro will be utilizing SBTs to drive social trading.

3.1 SBT Summary

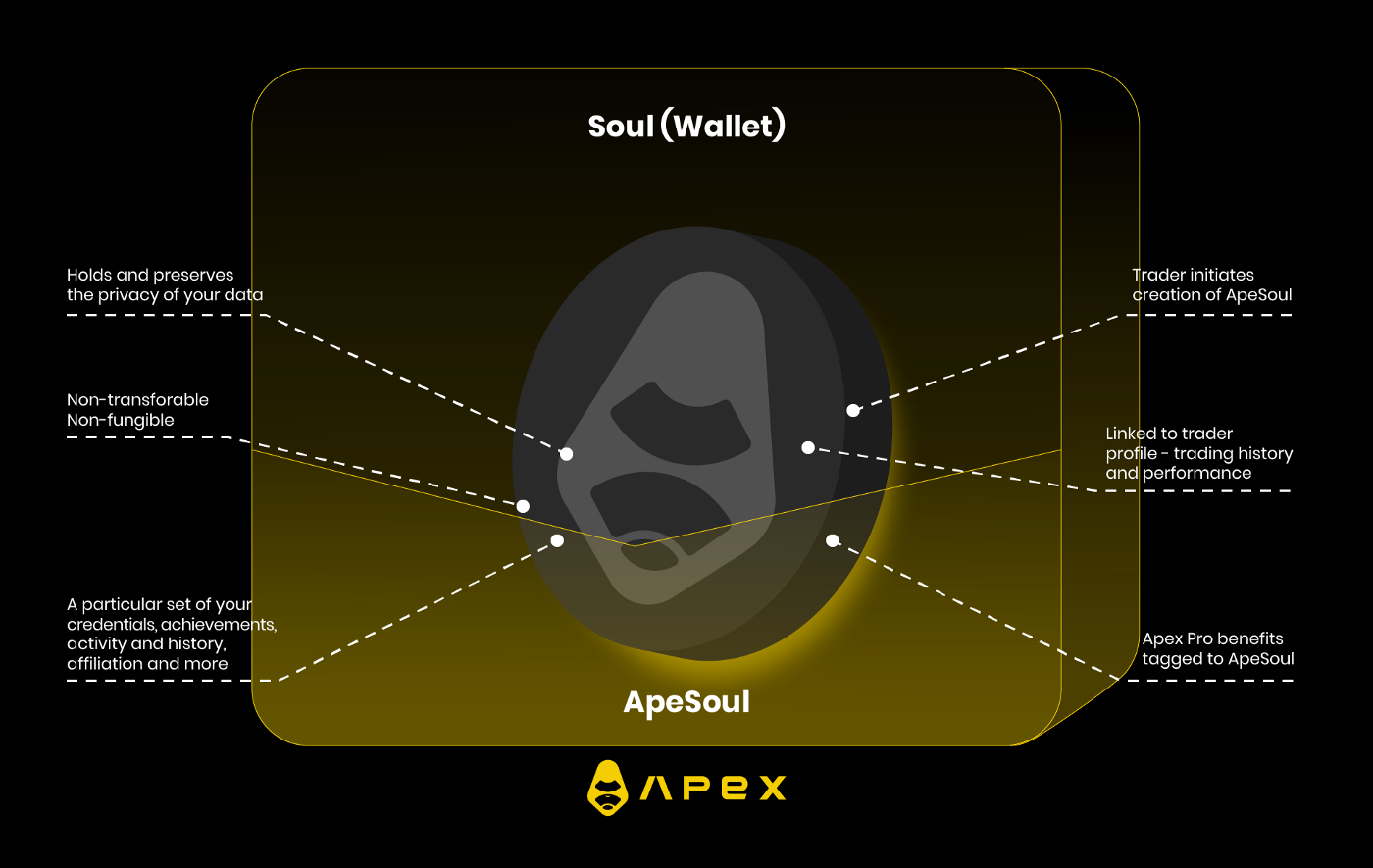

In a decentralized and privacy-preserving environment, ApeX Pro will assess the trading track records and reputation of a pseudonymous trader to select Principal traders via an SBT — a non-transferable non-fungible token (NFT) as coined by E. Glen Weyl, Puja Ohlhaver and Vitalik Buterin in May 2022 — called ApeSoul.

An SBT encapsulates and represents everything social, be they a person or entity’s credentials, affiliations or achievements across a variety of industries, from education to finance to even gaming and more. An SBT can be issued or revoked by any distribution party, including smart contracts, entities or decentralized autonomous organizations (DAOs), and is housed in wallets called Soul(s).

On ApeX Pro, the SBT ApeSoul will be used to establish a trader’s trading performance and reputation in a social trading model, erasing the need for manual verification via a centralized entity. Traders have full control over the creation of their ApeSouls.

3.2 How Traders Can Use ApeSoul

ApeSouls are linked to a trader’s trading profile (DID — Digital Identity), which includes data such as trading volume, number of trades, open interest, ranking, profits and more. With this, ApeX Pro traders can make their foray into Web 3.0 social trading, where Principal Traders can be determined automatically on the protocol via the data locked on a trader’s unique ApeSoul.

Other ApeSoul functions include:

Level Up: Use ApeX Protocol’s native token APEX to increase traders’ ApeSoul level. With every level rank promotion, their corresponding Soul will unlock greater VIP perks, including but not limited to higher trading fee discounts, or incentives from Trade-to-Earn events

Level Down: Traders can choose to level down their ApeSoul rank to access previously locked APEX at higher ApeSoul levels

Distribution: ApeSouls will only be created on-chain via zero-knowledge proofs when initiated by traders

Burning: Traders may choose to burn and destroy their ApeSoul and corresponding Soul via smart contracts on the ApeX Protocol

4. Tokenomics

APEX is ApeX Protocol’s native governance token, giving the community control over governance and protocol parameters.

As part of our Trade-to-Earn events, we also have introduced trading reward tokens, distributed among all traders based on their participation and performance.

4.1 Brief APEX Summary

APEX is the native token of ApeX Protocol and serves the following utilities:

Governance: Token holders can submit and vote on protocol governance proposals

Protocol Incentivization: Users can earn APEX tokens through participation rewards and liquidity mining on the ApeX protocol

Staking: Users can stake APEX tokens to earn more rewards in APEX

A maximum supply of 850,000,000 $APEX is available. Of this amount, 23% is allocated to the core team and early investors with a one-year cliff starting from the token generation event, followed by a two-year linear vesting period. The remaining 77% goes to the wider ApeX DAO and will largely be used for participation rewards, ecosystem building, and liquidity bootstrapping.

Note: In January 2024, we designed a $APEX tokenomics enhancement plan to cut down our total token supply in the first month of each quarter in 2024 as we aim to enhance scarcity and boost the value proposition of $APEX. More info here.

5. Functionality Forecast

The use cases for SBT and social trading are expected to expand into areas that can lead to the tokenization of data income and tangible realization of influence. This includes incorporating elements of SocialFi into ApeX Pro.

Remuneration & Incentive Scheme: Top-performing Principal Traders with excellent trading track records on ApeX Pro will receive additional rewards based on a two-pronged incentive scheme. Aside from assessing Principal Traders on their earned profit, their number of followers will be the other included criteria. Principal Traders will be incentivized to grow their following and earn follower-based perks. The positive elasticity of ApeX Pro’s community is heavily dependent on the dynamism of interactions between a Principal Trader and their follower group as it represents a microcosm of ApeX Protocol’s wider ecosystem.

Leaderboard Badge Program: ApeSouls will be tagged with a digital badge based on a Principal Trader’s performance and their ranking on the ApeX Pro Leaderboard. The badge is an indication of the trader’s growth on the trading platform.

6. Conclusion

ApeX Pro will shape the future of decentralization with social trading while continuing to foster community-led development and establish sustainable growth practices that can support the protocol in perpetuity.